Bitcoin Boom: Internet Scam or Digital Gold?

Filed Under : America, bitcoin, censorship, China, cryptocurrency, Federal Reserve, inflation, internet, money, NSA, technology by vemrion

Filed Under : America, bitcoin, censorship, China, cryptocurrency, Federal Reserve, inflation, internet, money, NSA, technology by vemrion Nov.18,2013

Nov.18,2013Remember when Bitcoin was $100? You know, like 2 months ago? Well now it has leaped up $100 in just 4 hours, rising from $500 to $600 USD before retreating slightly.

It seems the Little Currency That Could is making a run at $1000. We’ll soon see if it can make it before the bubble bursts again.

But why are people investing in this crazy “virtual currency” anyway?

When I first stumbled across Bitcoin back in 2011, I wasn’t sure what to make of it. It seemed a pretty quixotic goal, making a new currency just for the internet. I knew the network effect was critical for gaining any traction, and at the time it was just the province of a few cypherpunks, led by a mysterious figure known as Satoshi Nakamoto who hasn’t been heard from since 2010. This person or group started the whole thing with a white paper laying out how it would work. Soon the system was up and running. There were a few bumps along the way but this resilient idea has since caught on and now there are a flurry of competing crypto-currencies — that is, digital money that’s secured by lots of complex math.

There’s more to Bitcoin than just another internet scam or tulip craze. The underlying technology that makes Bitcoin work is not smoke and mirrors. You can see it working every day as money is transferred all over the world, nearly insantly. All you need is an internet connection, which of course is needed for any sort of online banking you do with traditional money. Bitcoin’s genius is making large-scale, distributed cryptography work for the masses.

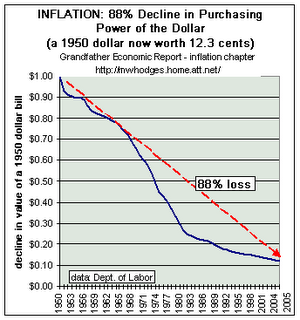

That’s the important point: Bitcoin works for the masses, unlike traditional fiat currencies like the US Dollar. Despite our democratic ideals, American money policy is decided behind closed doors by a secretive agency that fiddles with interest rates and makes huge bond purchases with money it creates from nothing. Transparency is not the Federal Reserve’s style.

Money for the masses

With Bitcoin, the code is open source and there is no central authority or bank — the job of verifying transactions is distributed across the globe. Don’t trust Bitcoin? Review the source code yourself and suggest changes if the security is not up to snuff. Let there be no mistake — Bitcoin is not yet out of “beta” and is not financed by a huge corporation with a strict delivery timeline. Nope, this is a bunch of self-appointed Guardian Nerds who mostly have day jobs not related to Bitcoin (except lead developer Gavin Andresen, who is paid by the nascent Bitcoin Foundation).

With that in mind, it’s best to think of Bitcoin as something that will be really cool and world-changing…

But it isn’t yet. Not until an easier payment system is deployed (it’s being developed now) and a stronger ecosystem of merchants accepting the currency emerges. What we’re witnessing now is a speculative landgrab because smart folks know that Bitcoin’s current market cap of 5 or 6 billion is chump change compared to what a fully mature, global digital currency would have if it were successful. To put it in comparison, Bill Gates could buy the whole Bitcoin economy nearly 10 times over, even in this midst of this bubble.

But is this a bubble or merely staggered massive growth?

Bitcoin versus traditional forms of money

Many valuations have been tossed about for Bitcoin. Most are probably overly optimistic, but the naysayers ignore the fact that Bitcoin was cleverly designed to be a store of value first and a currency second. It’s been derided as a “deflationary currency” even though it’s presently inflating at over 10% as new bitcoins are mined and put into circulation. Though misunderstood, Bitcoin is just on a somewhat-flexible schedule of inflation that will limit it to at most 21 million coins. It will take nearly 100 years for it to inflate from the present total of 12 million to its final total of 21 million. That’s not a bad thing — you can plan your life around that, whereas the Fed could change course tomorrow and you’d have no recourse except to try and compensate for what you think might be their new strategy.

Make no mistake: Bitcoin threatens inflationary currencies because it offers a release valve available to regular folks if the government and/or central bank decides to inflate your currency (as they inevitably do). That’s a good thing because competition among currencies can only help consumers and merchants. Central banks won’t be able to inflate secretly without the price of Bitcoin being affected.

Bitcoin is still pretty clumsy as a currency, but it works well as a store of value as long as you follow proper security procedures and principles. Does your password contain your name or birthday or even the word “password” in it? Does it have the string “12345” in it? Perhaps you should not buy any bitcoin until “Bitcoin Banks” emerge to offer security to the security-impaired. The bad thing about a global, distributed currency is that it can be stolen remotely too. Don’t skimp on the passwords and don’t keep everything all in one place, like your email account which could itself be hacked. Enable 2 factor authentication where available.

Soon, major merchants will start accepting Bitcoin because they want to save money on credit card transaction fees and/or Paypal charges. Bitcoin is close to free (currently around 3 cents, regardless of the size of the transaction) versus the 2 or 3% fee associated with credit cards.

China: the sleeping giant awakens

Much of the current boom has been driven by enthusiasm in China. During the last huge bubble in April China was barely a participant. This time they are driving the whole market and are responsible for more than half of all exchange trades which consistently outweighs the USD. The Chinese seem to like Bitcoin. A lot.

That means we’re in uncharted waters. Who knows the depths of their desire for bitcoin? Their proclivities could change the world because the Chinese and westerners have different philosophies of money. The Chinese are savers whereas the West has encouraged spending and investment through inflationary currencies that need to be earning you money or solving a problem, or else they are losing value. Much of western civilization is predicated on this quirk of our monetary system. Before, the only way to opt out was to buy gold and silver, but Bitcoin offers a new way to preserve value over time, but has the advantage that it can be sent anywhere in the world cheaply and in about an hour.

That’s why people have taken to calling Bitcoin things like Digital Gold and Gold 2.0. It could become a whole new asset class.

Bitcoin is a blessing and a curse for the Obama Administration

That’s been a problem for the US Government — it doesn’t know how to classify Bitcoin for tax and regulation purposes. Is it a currency? A store of value? An asset? A security? A collectible? A stock in some hippy/libertarian enterprise? All of the above?

While many observers thought that the US regime would quickly make Bitcoin illegal because of its threat to the US Dollar, it now appears Washington is going to take a more wait & see approach, partly because the Chinese boom seems certain to incubate a new wave of start-ups and millionaires just like the early PC revolution did in the 80s and the internet boom did during the late 90s. Lawmakers face a stark choice: Do you want this new round of innovation to happen in Silicon Valley… or Shanghai?

Besides, Obama/Congress making Bitcoin illegal would only apply to the US and would only serve to drive it underground. The Feds could try to eradicate it on the internet (at the cost of our liberties), but they would ultimately succeed only restricting commerce. Bitcoin is easy enough to hold offline as a paper wallet. I’m not sure if the US government even still bothers to feign interest in the plight of oppressed peoples living under dictatorships unless there happens to be some oil nearby, but if they did care, Bitcoin is a great way to effect commerce outside the grip of a despot. The obvious early candidates for Bitcoin merchants is any business involving the internet so buying a web domain with bitcoin is already possible. Soon other anti-censorship tools could become available with a digital currency that is difficult for authorities to track if you use appropriate anonymizing tools.

Is Bitcoin anonymous? Sort of.

It should be noted that Bitcoin is not fully anonymous. In fact, every transaction ever made is stored in a huge public ledger (the “Blockchain”) that is hosted and shared by anybody running a Bitcoin node. This helps verify that coins aren’t spent twice and ensures that only the person with the private key can access them. However, you can take steps to make sure no one knows you have that address. Bitcoin addresses are called “wallets” and they are basically both the wallet and bank account of Bitcoin. You can create a new one with a click of a button. No identifying information is required, but the NSA will still be spying on all your activities on the internet (as I’ve been saying for years, but we’re all supposed to be shocked) so tread with caution.

Golden Future: What does the future hold for Bitcoin?

So what does the future hold for Bitcoin? No one knows for sure, but I think we are watching history unfold. People scoffed at the idea of a personal computer. They scoffed at the internet and at mobile phones too. Yet the tide of history flows onward like the River Nile, demolishing our preconceptions and old ideas that no longer serve us in its inexorable ebb and flow.

In the wake of the financial disaster of 2008 and the lingering malaise (even as the Dow breaks 16,000), we have to wonder if our current concept of money is still working. In the old days, money was gold. Or silver. But we banished that idea to the distant past when paper money (which were originally certificates redeemable for gold or silver) caught on. But in the age of derivatives and CDOs and quantitative easing, perhaps it’s time to reassess if paper money — which somehow transformed into digital money in the last few decades — is really helping us.

So the idea of digital money isn’t even new. And neither is Bitcoin’s slow, steady inflation level because it mimics how gold is mined. But the idea of a currency created through cryptographic equations and run on normal PCs is radically new and revolutionary. Could it be that Bitcoin is the best of both worlds, the best of the old and the new?

Time will tell. But Bitcoin is just the first of what promises to be many cryptocurrencies. If Bitcoin doesn’t get it right, it’s likely that some other crypto-coin will.

Learn more about Bitcoin at WeUseCoins.com. Bitcoin has a significant learning curve and it’s worthwhile to invest some time into understanding it before you dive in. And if you’re going to buy in, wait until this current bubble pops. And pop it will, but I bet it will still be higher than it was 2 months ago.

You might be telling your grandkids about way back in your day when a bitcoin was only worth 600 dollars. And your grandkids will ask, “What’s a dollar?”

This post currently has

no screeches.

This post currently has

no screeches.

This is a decent article, but Krugman has to recognize that inflation is basically government theft. The Fed controls how much inflation there is by printing cash and making loans. The fact that there’s usually money to be had keeps us out of trouble, but political and economic forces can also cause inflation (oil prices, for example). Even the moderate amount (small by Fed standards) of inflation we’ve experienced lately is too much because it’s so continuous. A few deflationary periods ever now and then wouldn’t hurt. There would be less money in circulation, but the cash you did have would become more valuable.

The Fed’s insistance of constant boom times has created a boom-bust cycle when we should have a normal up and down cycle. I think it’s time we take a look at where the Fed is leading us and ask whether they have people’s interest at heart. After all, they are not elected, yet they control our encomony, which is arguably even more important (read: more powerful) than our democracy (such as it is). I think we need to take a long, hard look at the Fed and wonder if we really need it.

Some quotes about the Federal Reserve System:

“From now on, depressions will be scientifically created.” — Congressman Charles A. Lindbergh Sr. , 1913

“The financial system has been turned over to the Federal Reserve Board. That Board administers the finance system by authority of a purely profiteering group. The system is Private, conducted for the sole purpose of obtaining the greatest possible profits from the use of other people’s money” — Charles A. Lindbergh Sr., 1923

“When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.” — Boston Federal Reserve Bank

“I have never seen more Senators express discontent with their jobs….I think the major cause is that, deep down in our hearts, we have been accomplices in doing something terrible and unforgivable to our wonderful country. Deep down in our heart, we know that we have given our children a legacy of bankruptcy. We have defrauded our country to get ourselves elected.” — John Danforth (R-Mo)

“I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a monied aristocracy that has set the government at defiance. The issuing power (of money) should be taken away from the banks and restored to the people to whom it properly belongs.” — Thomas Jefferson, U.S. President.

“If Congress has the right [it doesn’t] to issue paper money [currency], it was given to them to be used by…[the government] and not to be delegated to individuals or corporations.” — President Andrew Jackson, Vetoed Bank Bill of 1836

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and it’s issuance.” — James Madison

“The few who understand the system, will either be so interested from it’s profits or so dependant on it’s favors, that there will be no opposition from that class.” — Rothschild Brothers of London, 1863

“Most Americans have no real understanding of the operation of the international money lenders. The accounts of the Federal Reserve System have never been audited. It operates outside the control of Congress and manipulates the credit of the United States.” — Sen. Barry Goldwater (Rep. AR)

“Whoever controls the volume of money in any country is absolute master of all industry and commerce.” — James A. Garfield, President of the United States

“Banks lend by creating credit. (ledger-entry credit, monetized debt) They create the means of payment out of nothing.” — Ralph M. Hawtrey, Secretary of the British Treasury

“To expose a 15 trillion dollar ripoff of the American people by the stockholders of the 1000 largest corporations over the last 100 years will be a tall order of business.” — Buckminster Fuller

“Every Congressman, every Senator knows precisely what causes inflation…but can’t, [won’t] support the drastic reforms to stop it [repeal of the Federal Reserve Act] because it could cost him his job.” — Robert A. Heinlein, Expanded Universe

“It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” — Henry Ford

“The regional Federal Reserve banks are not government agencies. …but are independent, privately owned and locally controlled corporations.” — Lewis vs. United States, 680 F. 2d 1239 9th Circuit 1982

“We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it.” — Congressman Louis T. McFadden in 1932 (Rep. Pa)

“The Federal Reserve banks are one of the most corrupt institutions the world has ever seen. There is not a man within the sound of my voice who does not know that this nation is run by the International bankers.” — Congressman Louis T. McFadden (Rep. Pa)