An Obviously-Brilliant Proposal

Filed Under : America, capitalism, Congress, corporatism, corruption, crime, elite, funny, money, satire, study by vemrion

Filed Under : America, capitalism, Congress, corporatism, corruption, crime, elite, funny, money, satire, study by vemrion Aug.12,2008

Aug.12,2008Er… wait, was it “modest” or “obviously brilliant”?

Regardless, I have an idea, everyone! Stand back, place safety goggles over your eyes, make sure the lead-lined X-ray bib is securely fastened to your chest and that your boots tied up tight.

Some Background

Now, I may be an old-fashioned (young) guy, but I believe that fair is fair. And our tax code, ladies and gentlemen, is not fair.

For instance, did you know that:

Two-thirds of U.S. corporations paid no federal income taxes between 1998 and 2005, according to a new report from Congress.The study by the Government Accountability Office, expected to be released Tuesday, said about 68 percent of foreign companies doing business in the U.S. avoided corporate taxes over the same period.

Collectively, the companies reported trillions of dollars in sales, according to GAO’s estimate.

What a sweet deal for them! They get to operate without having a huge tax burden weighing down on them, freeing them to make more investments and take more risks.

Of course, they have a shitload of capital, credit and resources to begin with. But this is America, goddammit! We don’t make corporations pay taxes no matter how much they fuck up the environment or make insane profits on the backs of their low-income workers.

But — and I’m getting to my ridiculously cool proposal — I can’t help but think that it’s not especially fair that multi-billion dollar companies don’t have to pay any taxes (ZERO fucking taxes) whereas, I, as a Regular Joe, have to pay about 30% of my income in taxes every year.

Perhaps I am just a whiner, not fit to lick the boots of a mighty multinational like Wal*mart. I know, I know. This is America. Corporations have more rights and resources than regular citizens. Yeah, “The Constitution guarantees…” blah blah blah… Obviously the Constitution don’t mean shit. Money talks and the Constitution was written on hemp paper by a bunch of proto-hippy revolutionaries who wore funny clothes and probably squealed like girls when tickled.

This is America, goddammit! We drive hummers and invade countries full of smelly brown people who are all determined to kill us (our Media assures us this; it must be true!) or even just because they looked at us funny. We don’t have time for “rules” or “equality” or what’s it called.. uh…. libraries? .. no… uh, — “Liberty!” Yeah, that’s it.

But what I want is not to return our country to the whole Constitution thing. I’m not that naive. However, I do think it would be freakin’ neat if we lived in a country where lawful citizens were counted as 3/5ths of a corporation. Currently, we’re about a zillionth of a corporation, so 3/5ths would be a vast improvement.

My Blindingly-Awesome Proposal

U.S. citizens, when paying their taxes, should be able to write off “overhead“. Only our “profits” should be taxed.

That means, no taxes should be administered until after the essentials of running a healthy body/mind have been accounted for.

What are the essentials? Food, water, shelter and clothing are a good start (no, a big screen TV is not an “essential”). That means I should be able to deduct all of the money I spend on food, rent/mortgage and clothes (within reason) before any other deductions. A healthy mind is important, too, so education costs, books and maybe even an internet connection should also be deductable.

Also, I have to have certain things in order to do my job — or even get to it — like a functioning car, gas, a bunch of hygienic equipment to look/smell nice, a cell phone and a computer. That’s all overhead; my paycheck is not “profit.” It’s revenue. I have to spend a big chunk of it just to stay alive and another chunk to fit into the corporate world. These are expenses and they are subtracted from revenue before you end up with profits — if you have any.

As you probably know, only corporate profits are taxable. Most overhead costs (the costs of running a business) are exempt. Wikipedia lists examples of overhead expenses as follows:

Overhead expenses include accounting fees, advertising, depreciation, indirect labor, insurance, interest, legal fees, rent, repairs, supplies, taxes, telephone bills, travel and utilities costs.

So I should be able to deduct my high-paid accountants as well. Then I can make sure, like most corporations, that I pay no income tax. Alternately, we could just leave gaping loopholes in the tax code so normal people don’t have to hire expensive accountants (and then deduct the costs of their services). Something like, “if you don’t feel like paying any income tax this year, check this box.”

So you see, my super-cool proposal just brings Joe Sixpack into the same league as the corporations, who already have incredible advantages in the economy because of their size and reach.

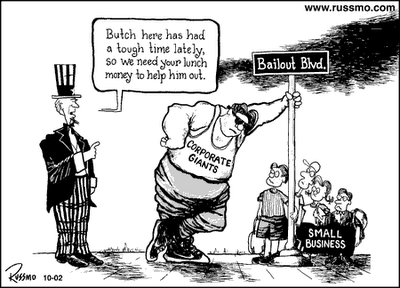

Corporate Welfare is Only for Wealthy Corporations

Small businesses generally take it up the rear as well since they can’t afford all those slippery accountants. Or maybe those small businesses just need to take a page from the criminals on Wall Street and learn how to privatize profits while socializing losses.

It doesn’t seem fair to me that the average guy/gal has to assume the vast majority of the tax burden when most of are making jack diddly squat compared to a major multinational. Fair is fair. Progressive income taxation is based on the idea that the rich should pay a greater portion of their income because they can afford it and because they owe it to society; especially since the rich people/corporations take advantage of the situation and pay their workers a pitance while making them work long hours in often-dangerous conditions. Meanwhile, the CEO gets his taxes paid for by the corporation via what is known as a “gross-up”.

Think it’s unfair of me to use the corporate tax code instead of the individual one? Well, like I said, fair is fair. Corporations are increasingly using the individual tax code:

An outside tax expert, Chris Edwards of the libertarian Cato Institute in Washington, said increasing numbers of limited liability corporations and so-called “S” corporations pay taxes under individua

l tax codes.“Half of all business income in the United States now ends up going through the individual tax code,” Edwards said.

Turnabout is fair play.

Even though my brilliant tax proposal seems like a total giveaway I could make it a reality. If I had high-powered corporate lobbyists at my disposal I could enact all sorts of people-friendly laws. I’d use my army of ninja-lobbyists to get a 28-hour work week and every Friday off, along with guaranteed overtime for salaried workers and an Economic Bill of Rights for all.

Instead, the already-rich corporations have the lobbyists and they use them to get ever-greater amounts corporate welfare. Then they rewrite the laws so that the managers pay a lesser percentage of tax than their secretaries do, as Warren Buffett pointed out:

Speaking at a $4,600-a-seat fundraiser in New York for Senator Hillary Clinton, Mr Buffett, who is worth an estimated $52 billion (£26 billion), said: “The 400 of us [here] pay a lower part of our income in taxes than our receptionists do, or our cleaning ladies, for that matter. If you’re in the luckiest 1 per cent of humanity, you owe it to the rest of humanity to think about the other 99 per cent.”

Mr Buffett said that he was taxed at 17.7 per cent on the $46 million he made last year, without trying to avoid paying higher taxes, while his secretary, who earned $60,000, was taxed at 30 per cent.

Notice how he implies he could’ve made his effective tax rate much lower if he had bothered. But he didn’t. Badass. But most CEOs are not as cool as Warren… of course, he could probably stand to pay his secretary more than 60K a year if he’s making 46 million, don’t you think?

Anyway, the point is: The system is unfair. Let’s try to level the playing field a little bit.

My proposal is not to make humans equal to corporations. That’s crazy. I just want to make a person worth 3/5ths of a corporation. Is that too much to ask?

You can screech back, or trackback from your own site.

I love the idea of “personal overhead” especially as a new dad. Diapers are mucho expensive without a CEO’s salary to prop yourself up.

Awesome post. America truly does suck. It just sucks a little less than many other countries….so far.

And don’t forget that we won’t be getting our social security (that we’ve been paying into for our entire lives) when we retire either. Here’s an idea: let us deposit the money that is normally taken out of our checks for social security into our own IRA. I don’t give a rat’s ass about the redneck morons who will spend their money on Nascar hats and Keystone Light instead of saving it. To each his own.

Is this true? Many Corporate companies evade tax, in America? I think this is the reason why the country is in recession. Dude your proposal is awesome! Proposal writing with a little sense of humor is good to read.